During financial emergencies, securing quick funds can be a daunting task. While personal loans are a popular choice in Singapore, there’s a variety of options available. One such option is the CPF personal loan, tailored to specific individuals and offering swift access to much-needed finances for unexpected expenses like medical bills and home repairs.

Let’s delve into what a CPF personal loan entails, its eligibility criteria, application requirements, and how it compares to traditional personal loans.

What is a CPF Personal Loan?

A CPF personal loan in Singapore allows you to borrow against the savings in your CPF account. This form of loan is ideal for unforeseen expenditures, enabling you to borrow up to six times your monthly income at competitive interest rates ranging from 1% to 4% per month. Typically, the repayment period spans from 6 to 12 months post-loan approval or up to your 55th birthday. Read on to find out if you’re eligible and the prerequisites for application.

Eligibility Criteria

While CPF personal loans offer an appealing proposition, there are specific eligibility prerequisites to fulfill. You are eligible if you meet the following criteria:

– You’re at least 54 years old or approaching 55 years old.

– Your minimum monthly salary, as a Singapore Citizen or Permanent Resident, is $2,000.

– You can withdraw a minimum of $5,000 from your Special or Ordinary Account Savings.

Required Documents

To successfully apply for a CPF personal loan, ensure you’re a Singapore citizen or permanent resident and have the following documents at hand:

– Identity card/NRIC

– Proof of residence (utility bills, letters addressed to you, tenancy agreements)

– Proof of employment (recent pay slips, employment contract, certificate of employment)

– SingPass (for logging into CPF, HDB, and IRAS websites)

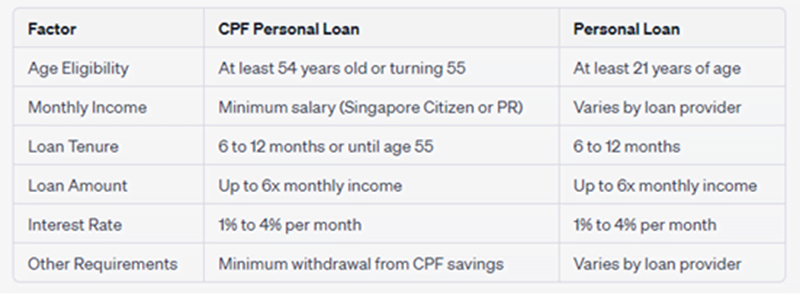

CPF Personal Loan vs. Personal Loan

A CPF personal loan and a traditional personal loan exhibit distinct differences in terms of eligibility, requirements, and loan tenure. The following table illustrates these variations:

To simplify your search for an ideal personal loan, Lendela is at your service. Our loan comparison platform assists you in finding the perfect personal loan in Singapore based on your specific requirements. After filling out an application form, our advanced algorithm matches you with suitable loan options from reputable banks and financial institutions. Secure your emergency funds today with Lendela’s expert assistance.

Frequently Asked Questions

How does a CPF personal loan differ from a personal loan?

A CPF personal loan requires applicants to be at least 54 years old or nearing 55. They must also be eligible to withdraw a minimum of $5,000 from their CPF savings. In contrast, a personal loan is accessible to individuals over 21 years old, catering to a wider range of people.

What is a CPF personal loan suitable for?

Ideal for Singapore citizens and permanent residents aged 54 or 55, CPF personal loans are designed to provide immediate funds for emergencies such as medical bills and home renovations.

What is the repayment period for a CPF personal loan?

CPF personal loans require repayment within 6 to 12 months or until the applicant’s 55th birthday (if they are at least 54 years old).

What are the interest rates for CPF personal loans?

Interest rates for CPF personal loans are capped at 4% per month.

What is the maximum loan amount for CPF personal loans?

You can borrow up to six times your monthly salary through a CPF personal loan.

Does applying for a CPF personal loan impact my credit score?

While a credit score isn’t essential for a CPF personal loan application, your application will be evaluated based on your credit history. Non-repayment can significantly affect your credit score.

How long does approval for a CPF personal loan take?

Approval for a CPF personal loan is swift, with some applications approved within as little as 30 minutes or a few hours.